Anywhere Anytime

Our Belize Bank Online Loan Application is EASY, FAST and CONVENIENT! You can easily apply for a loan from ANYWHERE at ANYTIME without having to visit a branch in person. This saves you time and effort.

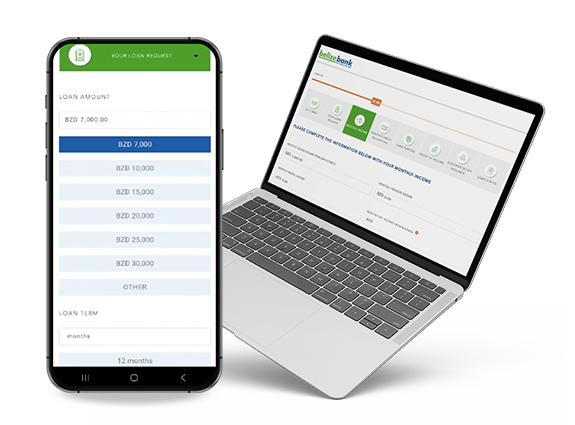

Apply From Your Phone

Belize’s first fully digital online loan application can be conveniently accessed by our customers via our Mobile Banking App and online banking platform. We also welcome applicants without accounts!

View Tutorial

Watch the full tutorial and learn how to apply as a Non BBL Customer

Why Use OLA?

- Seamless Online Customer Experience

- User friendly mobile and online application

- Available 24/7

- Quick approval and processing

- Dedicated customer support

- Flexibility – save and continue your application process anytime

- Accessibility – perfect for first time and existing borrowers and non- Belize Bank customers

- Trackability – offers you the ability to track your loan application status

Approval in One Business Day!

Here are the required documents to have on hand

AUTO LOAN REQUIREMENTS

Purchase Agreement

Ensure to have an electronic copy as this states the terms of the sale

Vehicle Photos

Ensure to provide vehicle photos as this is proof of the vehicle’s condition and value

Mechanic Evaluation

Download and provide us with the filled mechanic evaluation form

OTHER LOAN REQUIREMENTS

Valid Social Security Card

Ensure to have an electronic copy as this is required for proof of identity

Employment Letter

Download Employment Verification Letter and share with your employer (if employer doesn’t have one available)

Bank Statements

Provide statements only if you have loans at other institutions

Supporting Documents

Provide estimates or other evidence to support the purpose of your loan request

Cross-check your application - Submitting inaccurate information may cause unnecessary delays during the loan review process.

FAQS

The approval process should take a 1 business day and disbursement of funds takes max 2 business days provided that all required documents were provided.

How can I check the status of my application?

You simply need to login online, go to the online loan application option, and select the option ‘my current loan applications’. Non-customers, visit our website (provide link), select the option ‘I have a reference number’ and enter the reference number provided via SMS / Email.

Can I start my application and resume the process afterwards?

Of course, you can easily pause your application and restart the process at your convenience via the same channels previously used.

Does my application expire?

Yes, your application will expire after 3 months of inactivity.

Will I be able to contact my lender?

![]() Of course, we have dedicated lenders immediately reviewing your application. You can contact us at any time using the messaging option available online. We also have a dedicated phone line for Online Loan related queries. You can reach us at 221-8883.

Of course, we have dedicated lenders immediately reviewing your application. You can contact us at any time using the messaging option available online. We also have a dedicated phone line for Online Loan related queries. You can reach us at 221-8883.

We will need your social security and a valid driver’s license or utility bill to verify your address. We will also need supporting documents evidencing the purpose of your loan request and employment verification form (if available).

How does my interest rate online differ from a loan at the branch

Applying online gives you the opportunity to enjoy lower interest rates.

Can I apply for a vehicle and loan through this medium?

In the latter part of this year, we will be accepting online loan applications for secured loans. In the meantime, feel free to schedule your appointment with the branch and one of our lenders will be more than happy to assist you.

Can I refinance my current loan?

Of course, later this year we will be allowing you to refinance your loan digitally. In the meantime, feel free to schedule your appointment with the branch and one of our lenders will be more than happy to assist you.

Can I consolidate all my loans including those from other financial institutions?

Yes! Feel free to speak to one of our lenders about consolidating your loan facilities.

Can I get credit card together with my online loan applications?

Of course! Feel free to ask our online loans officer about obtaining a credit card. We will soon be adding this feature to our online loan application. Click here to download your application form.