Belize City, Belize – February 17, 2025 – The Belize Bank Limited (BBL) is pleased to announce that Caribbean Information and Credit Rating Services Limited (CariCRIS) has reaffirmed the Bank’s corporate credit ratings, highlighting its strong market position and financial stability. BBL’s regional rating remains at CariBBB- (Foreign and Local Currency), while its Belize national scale rating is reaffirmed at bzAA+ (Local Currency). This reaffirmation reflects the Bank’s high creditworthiness relative to other financial institutions in Belize.

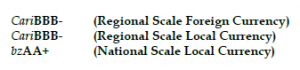

The ratings are as follows:

A copy of the CariCRIS Press Release can be viewed HERE.

CariCRIS has also maintained a stable outlook on these ratings, citing BBL’s continued profitability, a growing loan portfolio, and increasing adoption of digital banking solutions. The agency anticipates that over the next 12 to 15 months, the Bank will experience steady earnings growth, supported by higher fee income from digital transactions. While strategic and digital investments may lead to increased expenses, BBL is expected to maintain strong capitalization and good asset quality, ensuring it comfortably meets its financial obligations.

BBL’s reaffirmed ratings reflect its leading position in the Belizean banking sector, reinforced by an extensive distribution network and a robust risk management framework. Additionally, the Bank’s solid deposit base and strong liquidity position continue to support its financial strength. Ongoing digital transformation initiatives further bolster its operational efficiency and customer engagement. However, the ratings also acknowledge concentration risks within the Belizean economy and challenges associated with correspondent banking relationships, which continue to impact the broader financial sector.

Commenting on the ratings, Mr. Filippo Alario, Executive Chairman of Belize Bank Limited, stated:

“I am pleased to share that CariCRIS has reaffirmed Belize Bank’s regional and local credit ratings. This recognition reflects not only our strong financial position and disciplined risk management but also our consistency in delivering solid results year after year.

This reaffirmation reinforces my confidence in our strategic direction, particularly our focus on digital transformation, financial inclusion, and driving sustainable economic growth in Belize.

I want to personally thank our customers for their trust, our employees for their dedication, and our stakeholders for their continued support. Together we will continue to drive for excellence.”Belize Bank remains committed to delivering exceptional banking services and fostering financial inclusion, ensuring long-term value for its customers, employees, and shareholders.