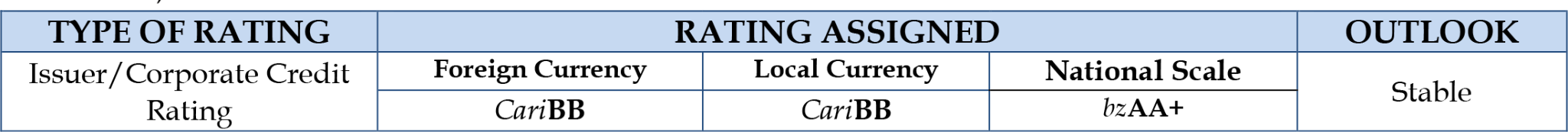

December 20, 2021 Belize City, Belize – On December 13, 2021, CariCRIS assigned the following “Investment Grade” rating to The Belize Bank Limited.

CariCRIS upgrades the credit ratings of The Belize Bank Ltd. by 2 notches

A copy of the full Credit Rating Report can be viewed here: CariCRIS BBL Credit Rating Report – December 2021

CariCRIS decision to upgrade BBL’s regional scale ratings is a direct result of improved fiscal conditions and projected economic improvement in Belize. They have also maintained a stable outlook on the ratings. The stable outlook is based on their expectation that BBL will continue to be profitable and maintain comfortable capital buffers despite the ongoing economic challenges facing the Belizean economy.

The rating of The Belize Bank Limited is a significant achievement for the Bank and the country of Belize as it represents an objective assessment of the Bank’s creditworthiness relative to other rated entities in the region and reflects their intimate understanding of the risks that are unique to the Caribbean.

The Belize Bank Limited continues to maintain a strong presence in the Belizean commercial banking industry with a wide distribution network. The bank’s operations are supported by a robust risk management framework, which is being enhanced by ongoing digital initiatives. Additionally, BBL’s deposit base continues to underpin its stable funding costs and liquidity position. The bank is also comfortably capitalized and reported improved asset quality and an improvement in profitability for the six month ending September 2021.

The Board of Directors and Management of The Belize Bank Limited takes this opportunity to commend the staff of the organization for their excellent work over the past years which has contributed significantly to the assignment of this rating.

Mr. Lyndon Guiseppi, Executive Chairman of The Belize Bank Limited stated that “The improvement in rating is supported by the BBL’s leading market share in the Belizean commercial banking industry. There has been significant improvements in the risk infrastructure and a focus on technology which support strategic planning. Asset quality remains good and and is supported by a reduction in non-performing loans. We are very encouraged by the improvement in rating and it motivates us to keep bringing a refreshing banking experience to our customers countrywide.”

Caribbean Information and Credit Rating Services (CariCRIS) is the Caribbean’s leading credit rating agency, with shareholding by regional Central Banks, several major regional commercial banks, and CRISIL, an associate company of the globally-recognized rating agency Standard & Poor’s.